When buyers begin the process of looking for their next home or if you are in the market for your first, most real estate agents will ask if you have been pre-approved from your lender. This is a very important first step in the process that many homeowners-to-be try to sidestep. It is critical because it saves buyers from falling for a home that is not in their price range or buyers realize they qualify for a higher mortgage than they thought. Either way, it is vital to know the facts.

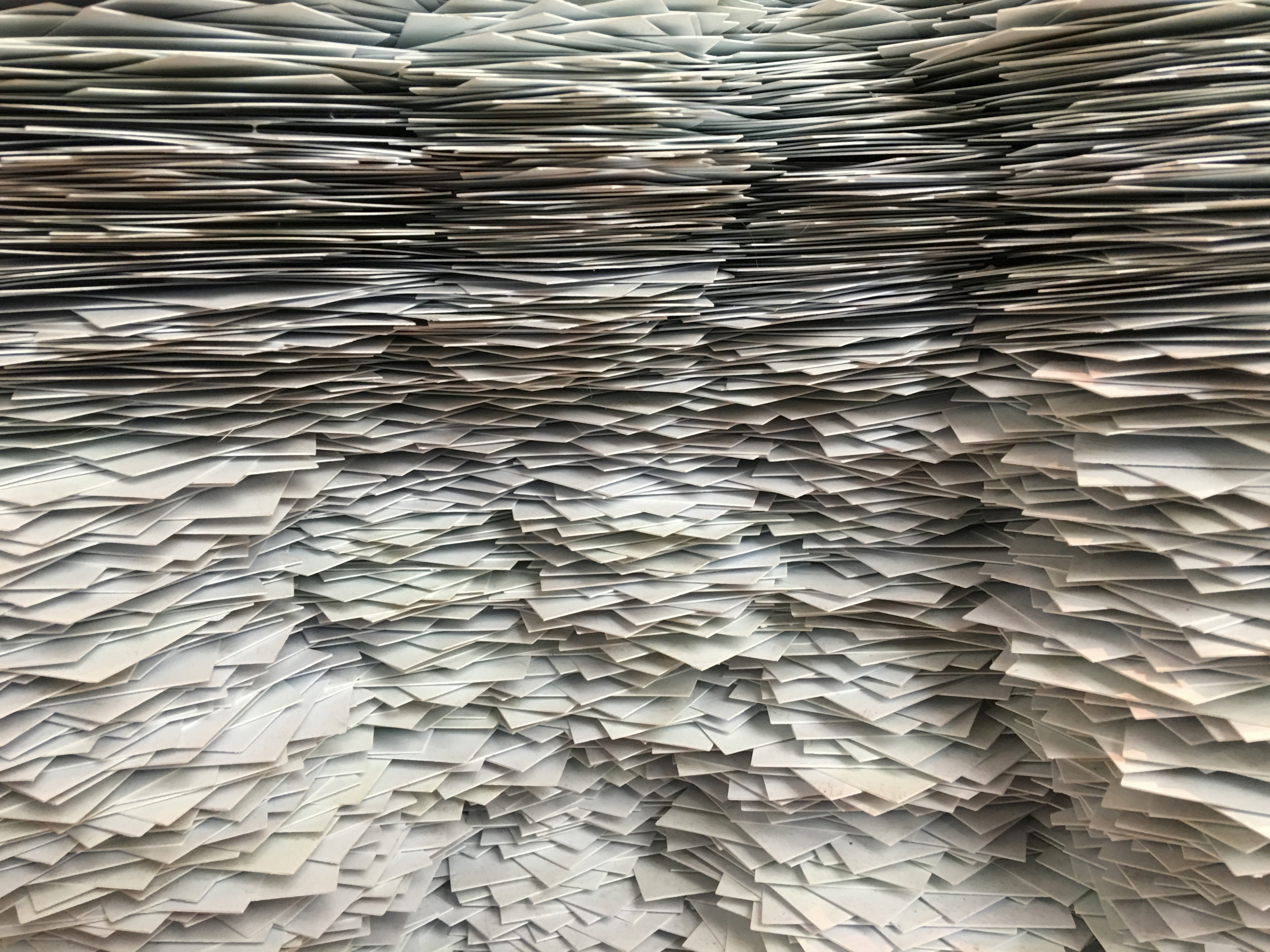

The biggest reason many avoid getting pre-approved is the wearisome process of providing all the documents lenders require. But buyers need to realize two things: 1) you will need to provide these documents to your lender anyways so this will get some of that out of the way and 2) any offer you make on a home will be considered more solid when it is accompanied with a Pre-Qual letter. This could mean the difference of “beating out the other guy” in a bidding war.

So, what information will your lender want? It depends on the type of loan you are applying for. The following article offers a checklist of documents depending on type of loan. Go to link: “Documents You Need for Mortgage Pre-Approval: A Checklist for Each Type of Loan” by Kelley Walters