FDIC Proposed Rulemaking: Residential Real Estate limit for Appraisal Requirements

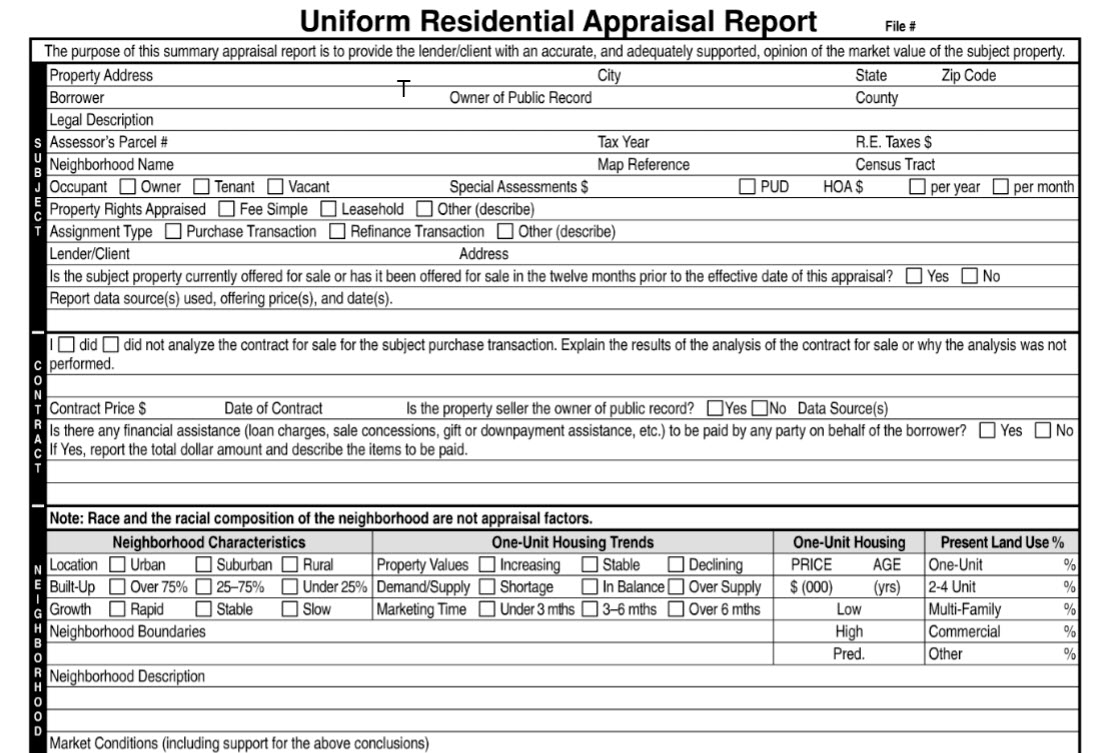

The Federal Deposit Insurance Corporation (FDIC) are proposing a new rule to raise the starting point for residential real estate sales requiring an appraisal to be triggered at $400,000. The reason for this is due to the concerns over the costs as well as the time required by appraisers in order to get a residential real estate transaction closed by the lender. The current starting point is $250,000, and the FDIC views increasing to $400,000 will provide a much needed break from the overwhelming current work load and requirements of residential appraisers without causing any detrimental issues for lenders.

The new rule would dictate for those real estate transactions under $400,000 to have an “evaluation with safe and sound banking practices”. This unburdens appraisers because the FDIC does not call for evalutions to be preformed by a licensed or certified appraiser. In other words, a real estate agent can provide an evaluation to the lender; and as a result, these evaluations are not the same caliber or encompass as much detail as the apparaisals and therefore the cost to prepare them is typically $150-$250 instead of $500 or more.

To read the full article “FDIC Issues Notice of Proposed Rulemaking to Exempt Residential Real Estate Transactions of $400,000 or Less from Appraisal Requirements” (released 11-20-2018)

FDIC press releases and other information are available at www.fdic.gov, by subscription electronically (go to www.fdic.gov/about/subscriptions/index.html) and may also be obtained through the FDIC’s Public Information Center (877-275-3342 or 703-562-2200). PR-87-2018